Estimating Heterogeneous Economies with Micro Data

Abstract

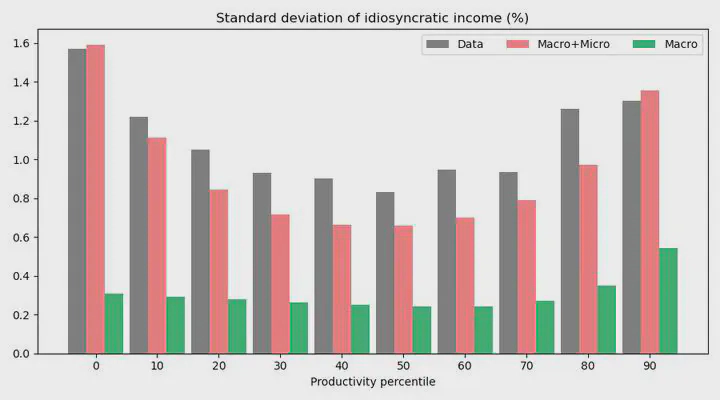

We give sufficient conditions under which dynamic equilibrium models with heterogeneous-agents can be represented by a first-order reduced-rank vector autoregression. We exploit this result to develop an econometric framework that enables the rapid estimation of a rich class of models with evolutions of both macro and micro data. In monte-carlo simulations, we show that our method including the micro-data delivers precision up to an order of magnitude larger than the conventional approaches. We apply our method to estimate a medium-scale HANK model with household-level heterogeneous exposures to aggregate fluctuations. Our estimates imply that poorer households are more sensitive to changes in aggregate income on average, and that this sensitivity is heightened conditional on a monetary policy shock. Through the lens of the model, our method estimates that heterogeneous earnings exposures amplify the consumption response to monetary policy shocks by 40%, substantially larger than those implied by traditional estimation methods.